LISTedTECH’s 2021 Grant Management System Report, released in July, tracks trends in higher education grant management systems. Although the research administration software industry is still in its infancy, over the past ten years, the awareness of the importance and value of grant management systems has increased significantly. The report notes that “grant management systems are just as critical to the efficiency of the institution as is a student information system.” While the report avoids debating the pros and cons of specific systems on the market, it does provide information and data analysis that is invaluable to any organization considering the purchase of research administration software.

Overall market leaders

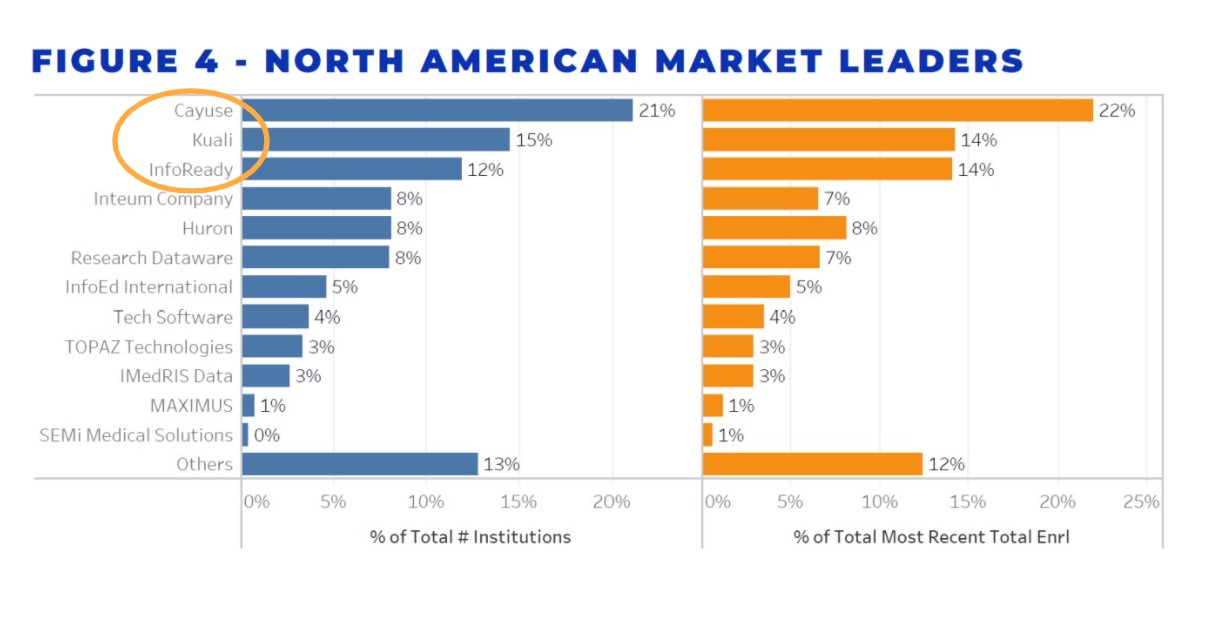

The report explores eRA software market leaders based on the percentage of unique client institutions (left graph) and the percentage of student enrollment at each institution (right graph). The figure below makes clear that, in both cases, the top three industry leaders are Cayuse, Kuali, and InfoReady.

Implementations in the last 5 years

Implementations in the last 5 years

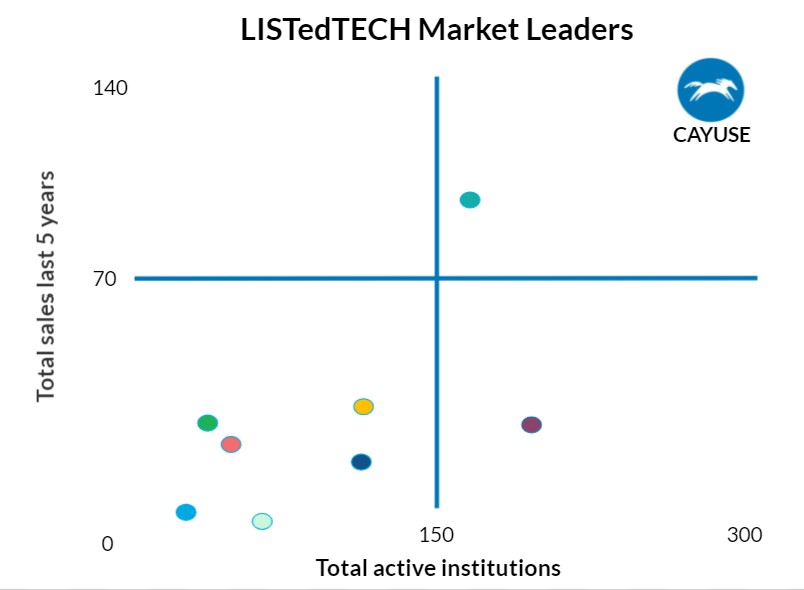

The graph below indicates total sales in the last five years and total active implementations. Cayuse and InfoReadyare in the top right quadrant showing up as overall market leaders, gaining more new clients than their competitors in the lower left and right quadrants. The top left quadrant would indicate the rise of a challenger to the market leaders, but ”this year, no companies have made it to this quadrant.”

Market evolution

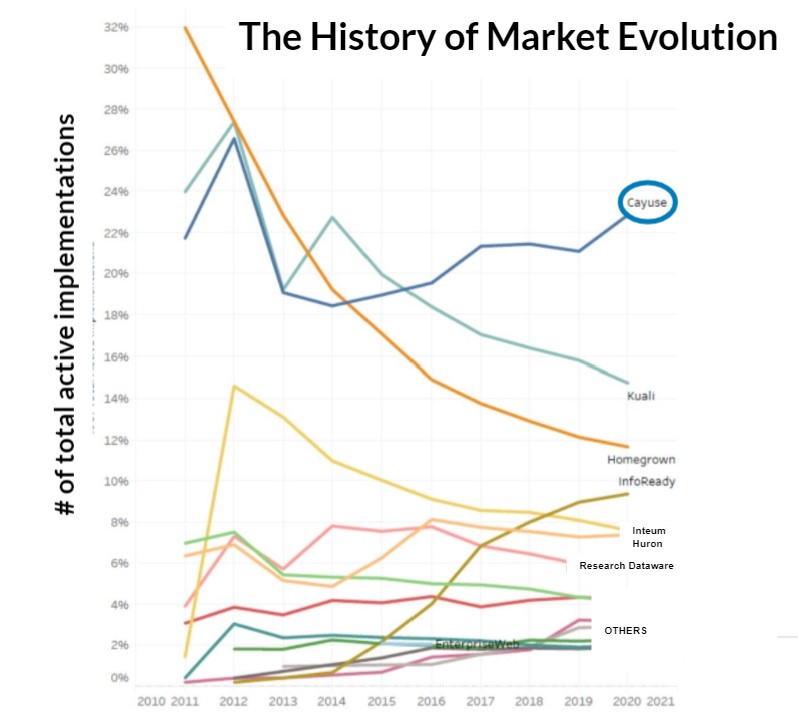

Between 2011 and 2020 there was a large drop in the number of homegrown grant management systems, as the graph below indicates. Cayuse remains the market leader in this scenario. Companies that maintained their client base may have seen a decrease in market share over time, due to overall market expansion.

The market shift toward full-suite platforms

Although homegrown options are no longer a go-to solution, homegrown solutions still make up 30% of grant systems. However, the market seems to be moving toward increased interest in full-suite platform solutions that meet the requirements for all aspects of the research lifecycle. Three companies are actively providing platforms designed to meet these needs: Cayuse, Dulles Technology Partners, and iMedRIS.

Of course, while these three providers offer a range of solutions, they must also integrate seamlessly with an institution’s existing systems. This is the point at which the question of configuration vs. customization can come into play. The report observes that “customization systems require an army of personnel, maintenance, and constant updates…” Highly customized systems generally do require more of an institution’s resources to maintain and update, and function best when hosted locally on an institution’s servers. Configurable solutions can still be tuned to meet an organization’s unique needs. Configurable cloud-based solutions offer low-cost maintenance, automatic updates to software and security, and easy access to tech support—all managed by the solution provider.

The upshot

“Cayuse and InfoReady are still steadily increasing their market share while other companies have a slower expansion. Cayuse continues to acquire market competitors helping them have a fuller product offering.”

Download the report

For a deep analysis of the grant management system industry, get your free copy of the 2021 report here and find out why “Cayuse is the market leader on all counts.”

Get the founder and CEO of LISTedTECH’s perspective. See our interview with Justin Menard here.