Recently ListEdTech released its third annual Grant Management System Report, compiling data from almost 1,500 North American higher education institutions to highlight trends in their use of grant management systems. Although research remains an essential sector in higher education, it is still relatively new to the world of enterprise SaaS platforms. While avoiding a debate on the advantages and challenges of specific systems, the 2022 report seeks to provide information that is not easily accessible but is useful in helping institutes choose between their options.

Recently ListEdTech released its third annual Grant Management System Report, compiling data from almost 1,500 North American higher education institutions to highlight trends in their use of grant management systems. Although research remains an essential sector in higher education, it is still relatively new to the world of enterprise SaaS platforms. While avoiding a debate on the advantages and challenges of specific systems, the 2022 report seeks to provide information that is not easily accessible but is useful in helping institutes choose between their options.

“Every major institution out there, even at primarily undergraduate institutions, are starting to focus on research because they need additional sources of income… One of the standbys is expanding their research portfolio, but what needs to be taken into consideration is everything that falls underneath that: having the infrastructure, increasing staff support, and increasing technology, it’s all intertwined.” Shacey Temperly, Attain Partners, September 2022 Webinar – Transformation and Evolution: The Role of People & Technology in Research Administration

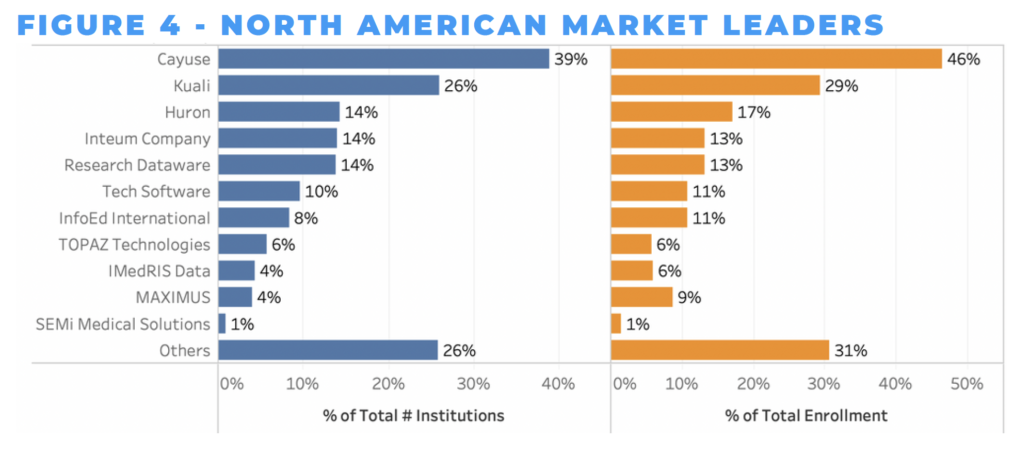

Overall Market Leaders

The report outlines eRA software market leaders by the percentage of clients based on unique higher education institutions (left graph) and as a percentage of the total student enrollment within each client institution (right graph). In both cases, Cayuse remains the market leader, followed by Kuali and Huron.

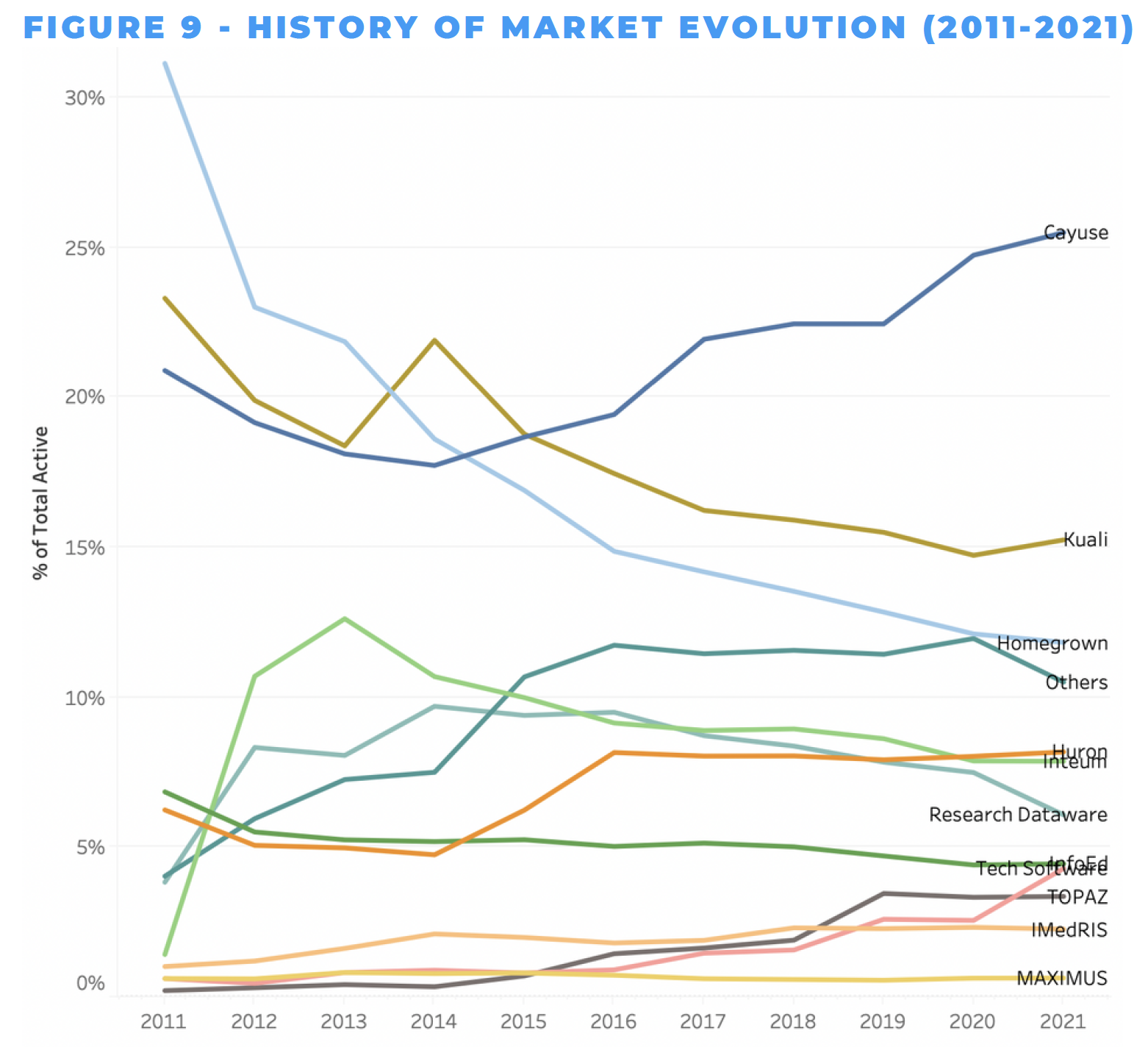

Market Evolution

“Over the years we’ve noticed different trends including Cayuse dominating from the market share point of view… They’ve been adding capabilities over the years to round out the full research suite, and they’re not losing any customers, so they’re doing something right.” Justin Menard, ListEdTech, September 2022 Webinar – Transformation and Evolution: The Role of People & Technology in Research Administration

Building on last year’s evaluation, the 2022 report includes a ten-year review of the grant management systems market evolution, shown in the chart below. While the report notes that “companies maintaining their client base see a decrease in their market share” due to “the overall expanding market”, Cayuse continued to increase its market share through 2021.

“Homegrown has been going down quite drastically… but grants was the last stronghold for homegrown systems. That trend has happened in all the other product groups, and this is the last one to go away.” Justin Menard, ListEdTech, September 2022 Webinar – Transformation and Evolution: The Role of People & Technology in Research Administration

2021 saw relatively little change in the grant management systems market, with Cayuse solidifying its position as the market leader while the once-common use of homegrown solutions continues to decline. While other companies have struggled with slower expansion, Cayuse has steadily increased its market share, with acquisitions helping to provide a fuller product offering and a more robust integrated suite.

With institutions still facing pandemic-related staffing, budget, and time constraints, as well as pressure from turnover and recruiting challenges, more are turning to integrated cloud-based solutions to reduce administrative burdens and increase operational efficiency. Technology as a force multiplier and recruiting/retention differentiator are trends that will continue to evolve in the coming years.

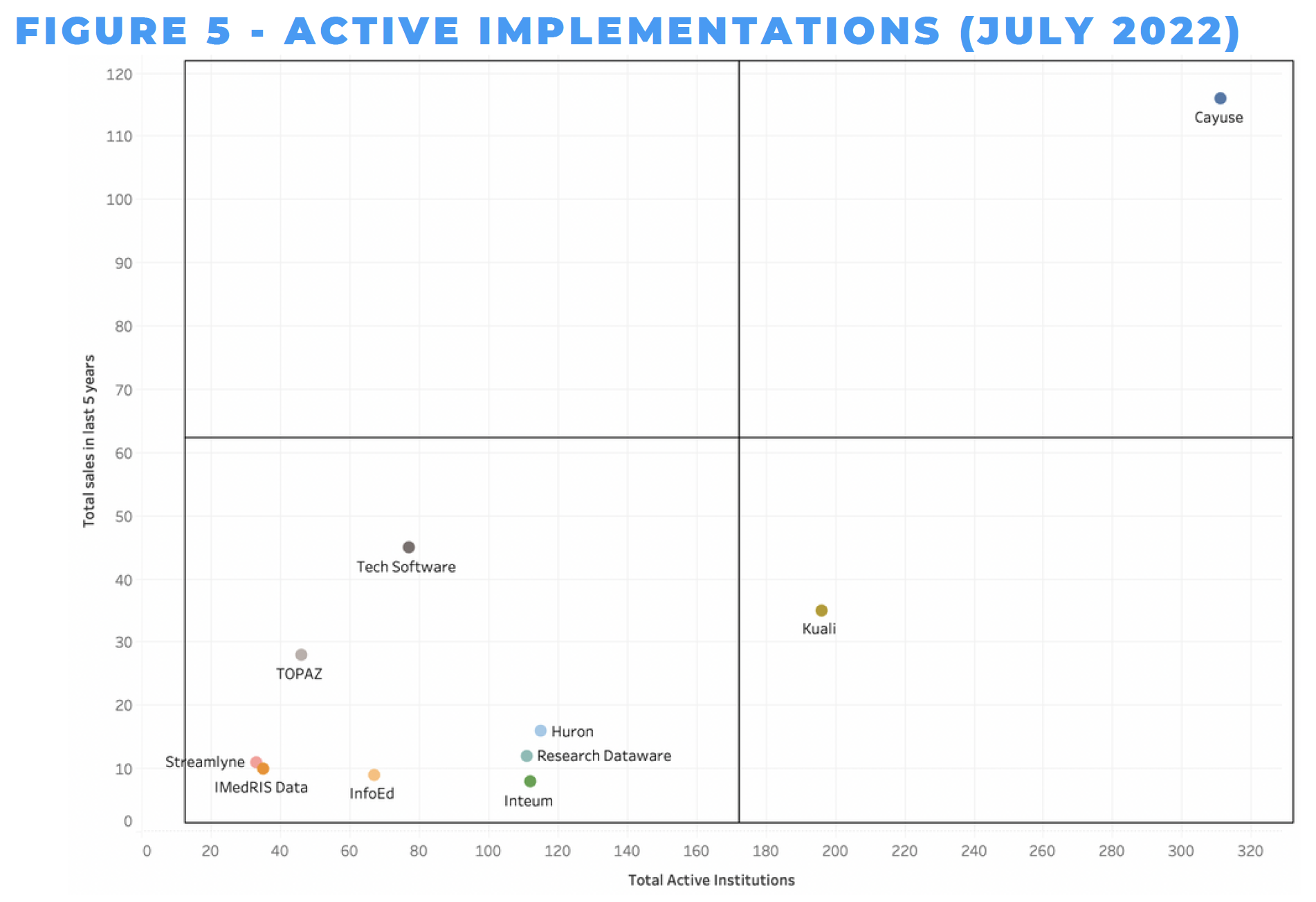

New Implementations vs Active Systems

The graph below uses data from over 1,000 active implementations to assess market leaders by total sales in the last five years and total active implementations. Since the last report, Cayuse remains the industry leader, appearing as the only company in the top right “market leaders” quadrant. While more movement is seen in the lower left “niche” quadrant compared to 2021, no companies appear in the top left “challenger” quadrant for the second year in a row.

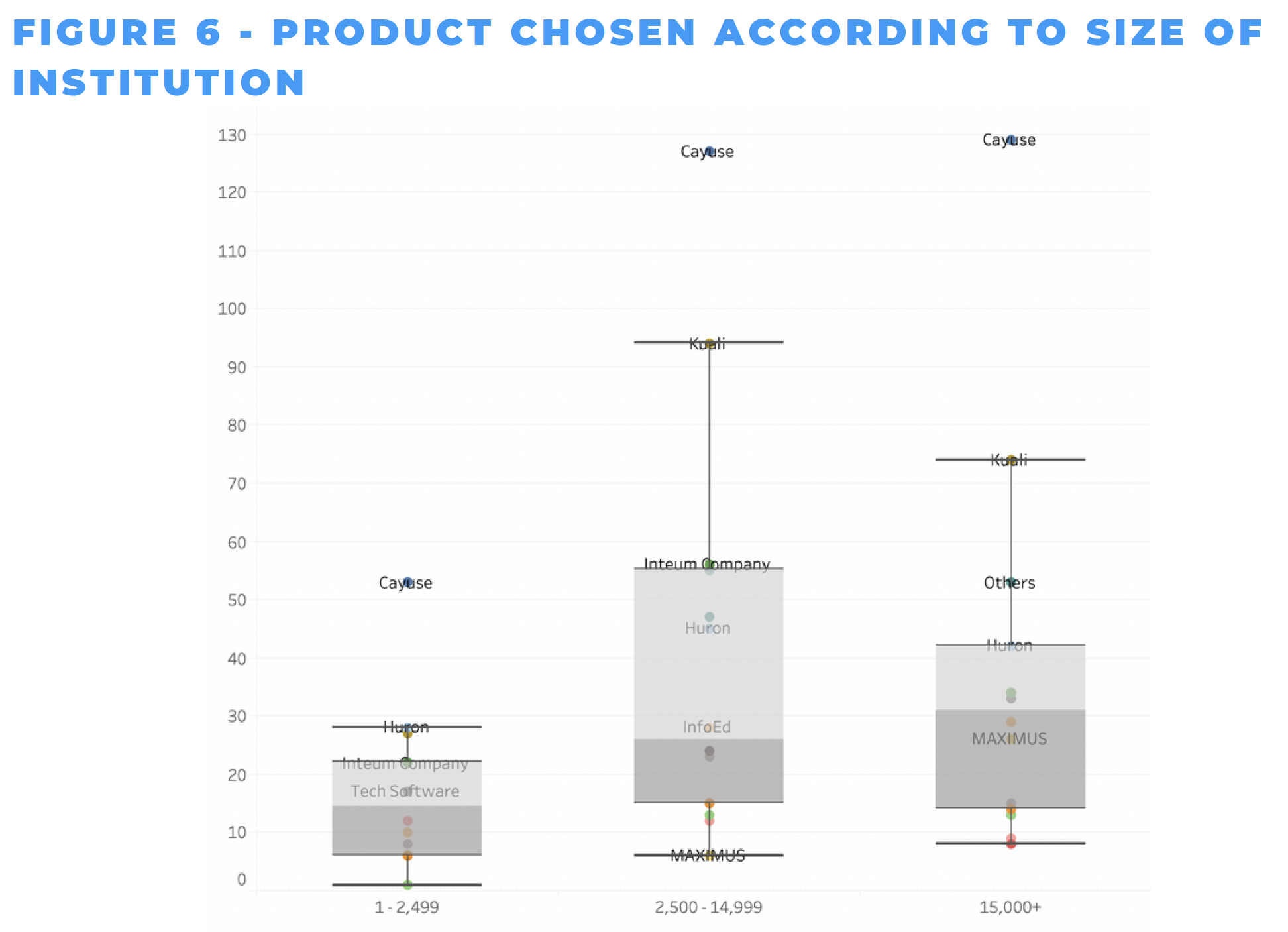

Implementation by Size of Institutions

“Even smaller institutions are realizing that they need something more sustainable, and that’s not what you’re going to find in a homegrown system.” Shacey Temperly, Attain Partners, September 2022 Webinar – Transformation and Evolution: The Role of People & Technology in Research Administration

The graph below compares implementations by the size of institutions, grouping institutions into three size categories (1-2,499, 2,500-14,999, and 15,000+). Cayuse remains the industry leader across all three size groups, followed by Kuali in the 2,500-14,999 and 15,000+ groups and Huron in the 1-2,499 group. While the report includes a disclaimer that “the institution’s size is not a critical point to consider when choosing a grant management system,” growing adoptions show that institutions of all sizes can benefit from implementing grant management systems.

To read the full 2022 ListEdTech report, download your free copy from https://cayuse.com/listedtech/

To learn more about how Cayuse can help expand your institution’s research capabilities, contact us here, or request a demo.