Today, we’ll look at the accounting processes and calculations required for monitoring indirect cost encumbrances.

What is indirect cost recovery?

Indirect costs, aka IDC, F&A, or Facilities and Administration, are costs that are not directly allocable to a specific sponsored project but are incurred for the joint benefit of multiple projects or activities. Some examples of indirect costs are:

- Executive and administrative staff

- Office space used by those staff

- Shared services such as janitorial, technology, etc.

- Shared equipment such as copiers, phone systems, servers, etc.

- Managerial functions such as audits, training, etc.

The budgets for most sponsored projects allow for a portion of these indirect costs, as defined in an organizational indirect cost rate agreement. This portion is computed by multiplying the amount of certain direct costs by a predetermined (negotiated) indirect cost rate, and the cost then become available for “recovery” once those direct costs are incurred. We use the word “recovery” because, in many cases, the indirect costs associated with a sponsored project are incurred and then reimbursed by the project sponsor.

(For more about indirect costs and their rates, consult the NIH Office of Management website.)

Monitoring indirect cost encumbrances

Monitoring indirect cost encumbrances involves five steps:

- Tracking outstanding encumbrance transactions by sponsored project

- Identifying which transactions generate indirect costs for recovery

- Multiplying the encumbrance by the appropriate indirect cost rate

- Applying an indirect cost cap if necessary

- Creating usable report formats

Applying these steps in a streamlined manner requires either a sophisticated spreadsheet or a grant accounting software system. When using spreadsheets, you’ll typically use a separate spreadsheet for each sponsored project, and record direct vs. indirect costs in separate columns.

But spreadsheets don’t make it easy. In fact, it’s hard to record and liquidate encumbrance transactions and identify which ones generate indirect costs. For these and other reasons, an accounting software solution is better, especially for R1 and R2 institutions.

Software for monitoring indirect cost encumbrances for sponsored projects

While ERP, general ledger, and purchasing systems used by research organizations usually provide accurate info with which to compute indirect cost expenditures, the same cannot be said of indirect cost encumbrances. In many cases, either the system was not originally designed for this purpose or the functionality was not implemented for the organization. That’s why a separate grant accounting solution helps.

In cases where a grant accounting solution is interfaced to the primary accounting system via a recurring import process, the grant accounting system is often referred to as a parallel system or data warehouse. When accounting transactions are manually keyed into the grant accounting solution, it is often known as a shadow accounting system.

Because managing indirect costs is a key part of grant accounting, computing indirect cost encumbrances is a main feature in most grant accounting software solutions.

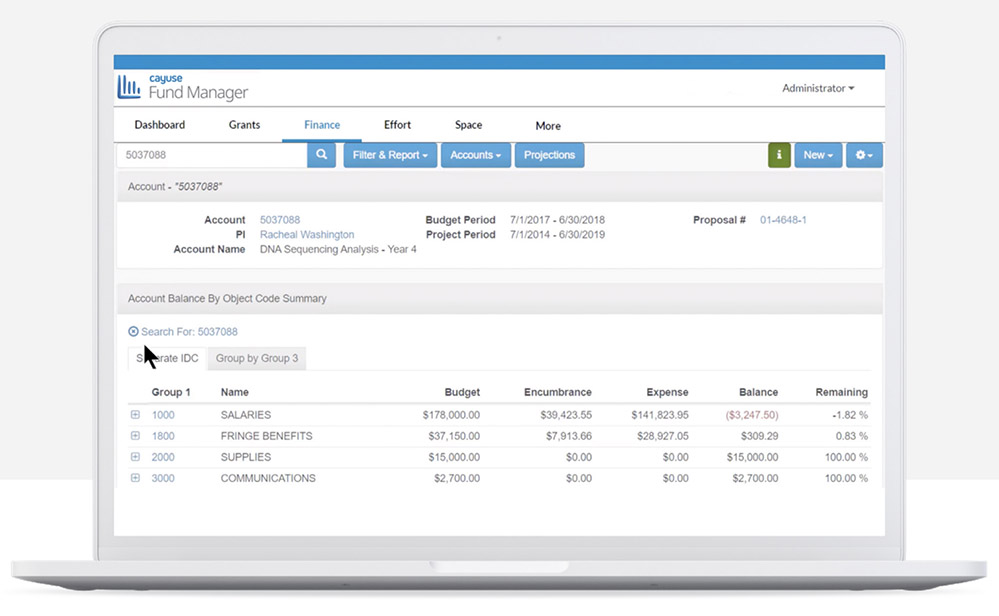

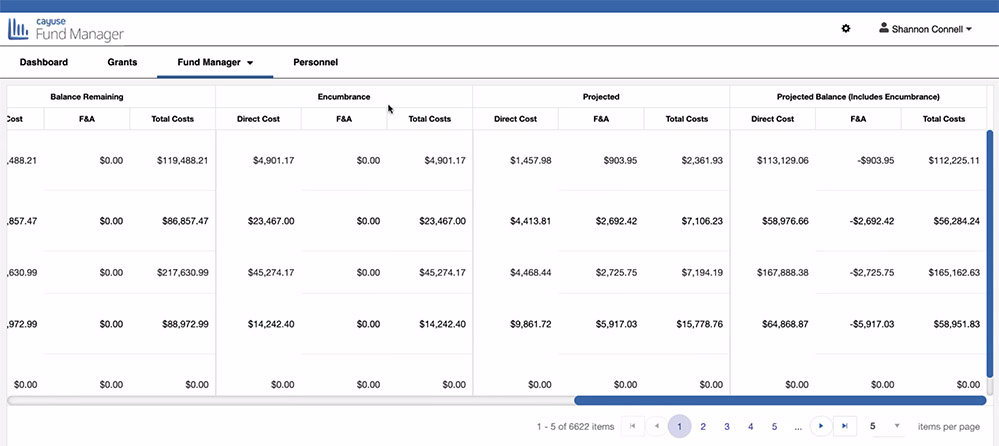

These systems track outstanding direct cost encumbrances, calculate the associated indirect cost encumbrances, and present the results in multiple report formats to meet research leaders’ needs. Most of these systems include functionality for monitoring indirect cost encumbrances for multiple indirect types and rates. Examples of different indirect cost types include: Total Direct, Modified Total Direct, Salary and Wages, and others.

Cayuse’s apps are a popular choice for monitoring indirect cost encumbrances. Learn more about Fund Manager here.