The first step: creating a proposal budget and justification

You can create a proposal budget with paper or spreadsheets, but by far the best and easiest way is with software to manage sponsored projects. Sponsored Projects, for example, includes both pre-award and post-award processes, so you can track everything from the proposal stage through the completion of the research. Tracking and reviewing previous purchases in research administration software makes it easier to estimate and budget costs for similar work, so proposed budgets are more accurate.

Some research organizations like to use research fund management software to track and monitor purchases and spending, including to forecast how potential purchases will affect the remaining fund balance on the award before the actual purchase is made. It’s more powerful than accounting software, which lists purchases but can’t prevent overspending or spending outside of grant conditions.

During the pre-award stage, when you’re putting together your budget and justification, it’s also important to review the sponsor terms and conditions associated with the potential funding so you can determine limitations on purchases or exclusions. Keep in mind:

- Supplies generally don’t require specific approvals, aside from the budget included in the proposal

- Capital equipment purchases typically do require specific approvals and justifications

Familiarizing yourself with the sponsor and institutional purchasing and procurement rules–as well as knowing how to differentiate between supplies, equipment, and capital equipment–will ensure more effective compliance, tracking, and reporting, both internally and for award sponsor.

What are supplies and equipment for a sponsored project, and which ones do you have to track?

Per federal guidance, supplies and small equipment have a per-item value of less than $5,000. Generally, the sponsor isn’t required to track these consumables. But in some situations, specific sponsor or institutional policies will require tracking of certain “high-value goods” or “sensitive materials.” These can include items that are considered supplies and small equipment according to the federal regulations, like computing devices, precious commodities, or sensitive chemicals and materials.

Also of note are supplies or small equipment purchased for fabrication. For example, a computer intended for use as a component in a high-end workstation or supercomputer becomes part of the fabricated capital equipment if the combined cost or the various components is $5,000 or more. This distinction affects not only indirect cost calculations but also tracking and reporting requirements.

What is capital equipment vs. fabricated equipment?

Capital equipment is something that has an acquisition cost over $5,000 and a useful life of more than one year. The cost includes all components and costs associated with acquisition. Unlike supplies or small equipment, the cost of capital equipment is capitalized or depreciated over the expected life.

Fabricated equipment is typically a specialized item not readily available from vendors in the marketplace. Multiple vendors may supply various components needed for fabrication but ultimately can’t produce or don’t provide the final product needed for the project. The cost of the fabricated equipment is determined by calculating the cost of all components and related costs necessary to its implementation.

Capital equipment and fabricated equipment are subject to the same rules as any other expense charged to a sponsored project. Additionally, these purchases are subject to the procurement requirements specified by the Office of Management and Budget at 2 CRF 200. As part of these regulations, you also have to evaluate whether renting the capital equipment is more cost effective than purchase.

5 types of procurement on a sponsored project

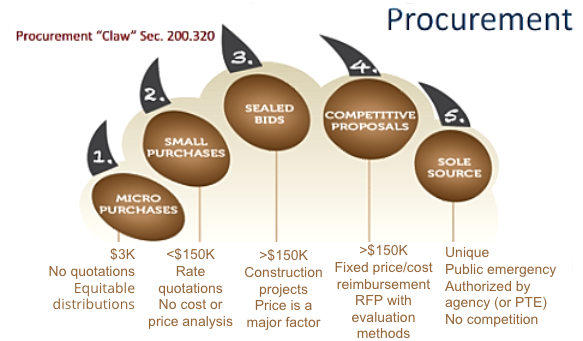

Gil Tran, a senior policy analyst with the Office of Management and Budget, diagrams the procurement requirements below:

In the diagram above, procurement is divided into 5 types. Through this process, remember to keep all documentation supporting your purchase for audit purposes. Let’s break down the procurement claw:

Micro purchases: These have the fewest requirements, while a sole source purchase has the most requirements.

Small purchases: If they’re under the acquisition threshold ($3,000-$150,000), you need at least three adequate and reasonable quotes from qualified sources.

Sealed bids: You need at least two formal sealed bids for construction projects to award firm, fixed-price agreements over $150,000.

Competitive proposals: These can be either fixed or cost reimbursed for projects over $150,000. While all procurements must reflect reasonable prices, other factors that would advance program or project objectives can also be taken into consideration when determining the most qualified competitive proposal.

Sole source: This is a non-competitive proposal. If the sources were deemed inadequate upon review, or to address a public exigency, express written authorization from the sponsor may be granted to seek a sole source proposal. You’ll need detailed documentation supporting the sole source approval before the award and to comply with the sponsored project requirements.

Kind of confusing, I know. Reach out if you have questions.