ListEdTech’s annual Grant Management System Report always reveals key developments in research over the past year. The recently released 2023 report is no different. Tracking trends in grant management systems used by more than 1,500 higher education institutions across North America, the comprehensive analysis serves as a valuable resource for research administrators, funding agencies, policymakers, and industry professionals.

Here’s a closer look at the findings from the new report to understand the current state of grant management systems and their effectiveness in supporting educational institutions.

Overall market leaders

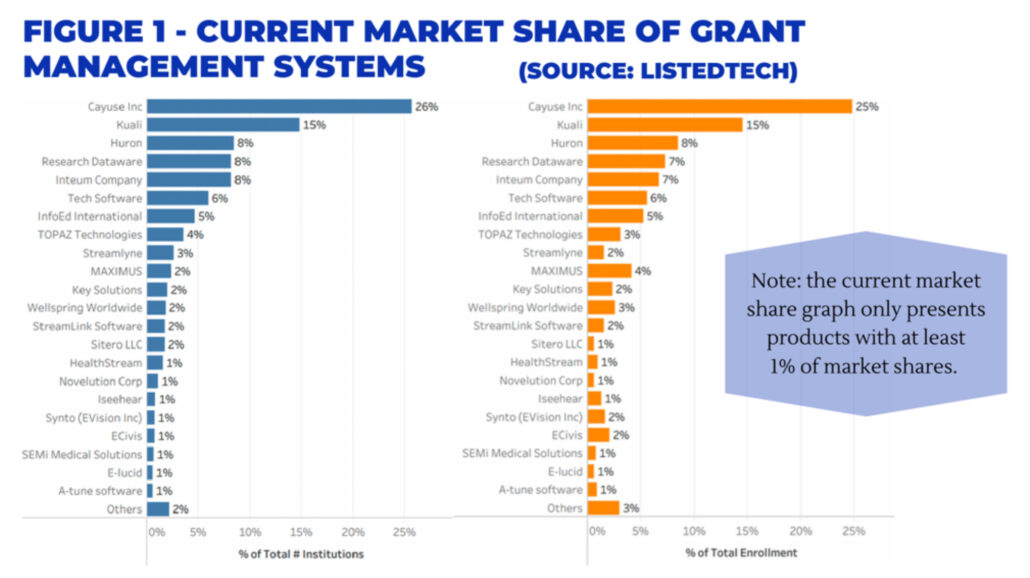

The report defines the overall leaders in the electronic research administration (eRA) system market by the percentage of total unique educational institutions and the percentage of total enrollments. In both evaluations, Cayuse is the clear market leader.

While Cayuse saw a slight shift in market share from 39% in 2021 to 26% in 2022, the report indicates this may be due to the increase in new vendors. This 2021 influx, along with acquisitions and changes to category dynamics, has transformed and expanded the market, further affecting companies across the board, all of whom have seen a decline in market share.

But historical market trends from the past decade show a clearer picture. Building from past evaluations, the graph below reveals how Cayuse continues to dominate its competitors, maintaining its client base and going from strength to strength.

Moreover, while other companies continue to struggle to find their footing, Cayuse demonstrates steady growth, expanding its overall reach.

Changes in market implementation

The report identifies no drastic market changes from the past year. Overall, 29% of institutions have implemented grant management systems. Although this is far from market saturation, it is still a tremendous increase from the 4% in 2014.

The top five companies hold 65% of the market share, offering similar core functionality within their grant management systems, including managing the grant lifecycle, decision-making, and grant disbursement.

For grantee systems, there is far more diversification, with companies like Cayuse offering customized systems for compliance, facilities research, funding opportunities, sponsored project management, and technology transfer.

Examining implementation by sector, the report shows grant systems are mostly used in public, four-year-or-above institutions (63%), followed by private, not-for-profit, four-year-and-above institutions (26%). In both of these sectors, Cayuse is the most popular vendor with the highest market share.

If implementation is assessed by research activity, there is a lack of concentration. Approximately 59% of grant systems are used in doctoral universities with high research activity, yet no vendor dominates. Still, Cayuse is among the top two vendors with a 1% share.

This lower share may be attributed to the presence of homegrown solutions. While the overall growth of these solutions has decreased, they remain present in three major institutional sectors:

- 35% in public, four-year institutions

- 14% in private, not-for-profit, four-year-and-above institutions

- 10% in public, two-year institutions

Market forecasts

Despite challenges, there is a strong indication of more institutions integrating grant systems into their infrastructure, as predicted in last year’s report analysis. If current implementations continue on their present course, particularly pertaining to grantee systems, the projected growth is expected to increase by 15% and reach 44% by 2027.

As pressure mounts for research organizations to expand their capacity and capabilities, leveraging these digital tools may become more critical. Even if grant management systems are not used specifically within the research domain, they can address other needs, such as financial tracking of research expenditures and revenue.

Alternatively, institutions may pivot from using specific grant management systems in favor of all-in-one solutions — such as research information systems — to integrate all aspects of research. Homegrown solutions may also see an increase as institution leaders seek to reduce overall costs.

Nevertheless, some grant management systems are clearly at the top, with Cayuse staying strong in the grantee subcategory. Ultimately, all grant subcategories are expected to continue their growth, as the market’s white space remains large.